Rigits uses our years of experience working with small businesses to improve your cash flows, grow sales and maximize profit — it’s like having a dedicated CFO at a fraction of the price. Here’s how it works:

Step 1

We dig into your numbers and run a health diagnostic on your business.

Step 2

We give you options, best practices, and KPIs for fixing the weak areas of your business model.

Step 3

We meet with you monthly to track your progress, fix roadblocks, and plan ahead for further growth.

You know you need to understand and act on the crucial numbers that drive growth. Let us help you uncover them. We are here to help you:

Maximize Profit

You know you could be more profitable but you’re not sure how. We help you drill down and figure out:

- Profitability by service, client, or project

- Your utilization rate (a measure of employee productivity)

- Tools to assess the profitability of different types of engagements (hourly, fixed fee, project based, etc.)

Improve Cash Flow

“I know I made money, but where did it all go?” The answer is hiding in your cash flow management. We’ll help you uncover:

- Your specific sales to cash cycle

- How AR management can be improved (so you get paid quicker)

- Your 13 week cash forecast so there’s no surprises

Grow sales

“I thought you guys were accountants. How can you help me grow sales?” Your numbers are always telling a story, and that story includes revenue. We’ll help you figure out:

- Your revenue drivers (an unbelievably powerful lever)

- Your cost of customer acquisition (and how to use it to make decisions)

- What specific leading indicators you should be tracking to increase revenue

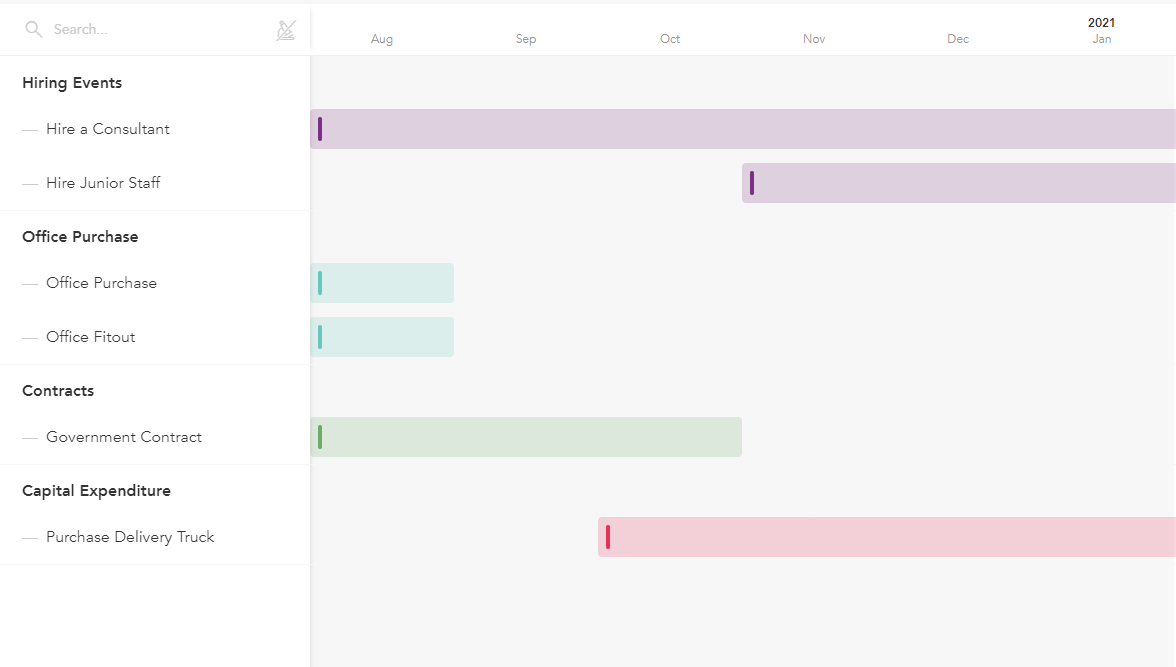

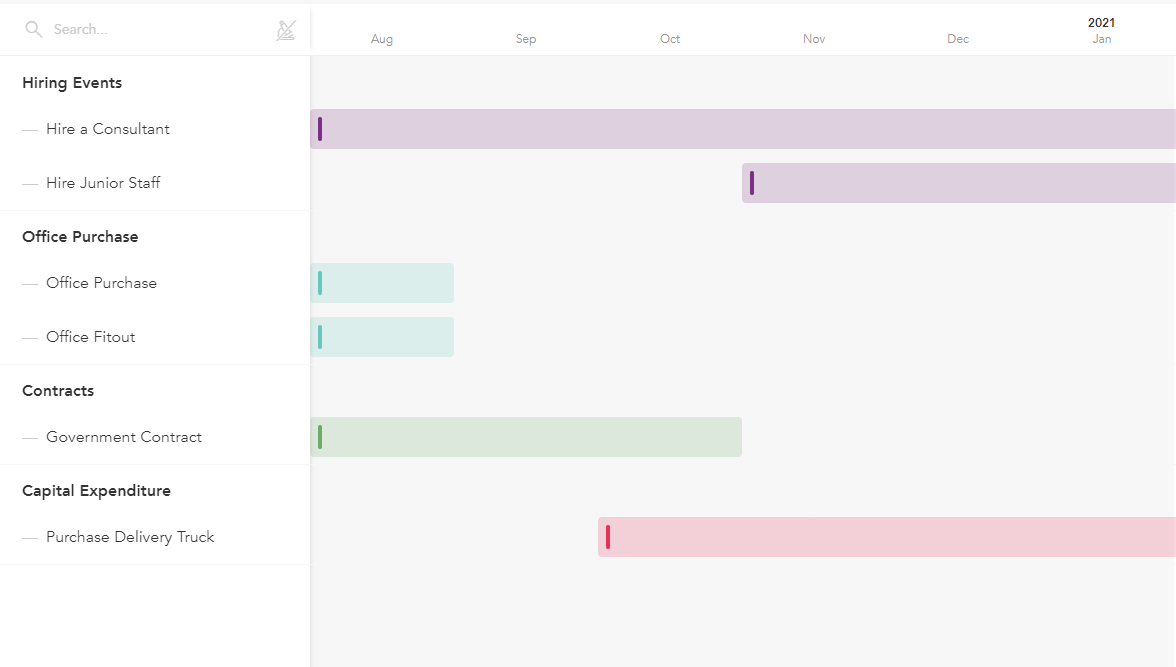

Creating Your Custom Financial Roadmap

If you have ever had a business coach, consultant, or mentor tell you to increase your time spent working “on the business” instead of “in the business”, you already understand why you need to master your numbers. That’s where we come in.

We drill into your financials, find high-leverage areas of improvement, and present you with options and best practices to fix them.

Then we help you look forward instead of backwards with financial modeling and forecasting. A good forecast should tell you things like:

- When you can afford to make a new hire and how much they should add to your bottom line)

- How much profit you’ll be making this year (and how much you’ll need to save for taxes)

- What mix of services you should be selling to reach your desired revenue (and profitability)

- How much debt service you can afford

- How long it will take to make your business attractive to buyers

Step 1

We hold a one-hour discovery call where we uncover your long-term vision for your business, what main stressors are keeping you up at night, and run your business through a health diagnostic which will tell us where the main issues are hiding.

Step 2

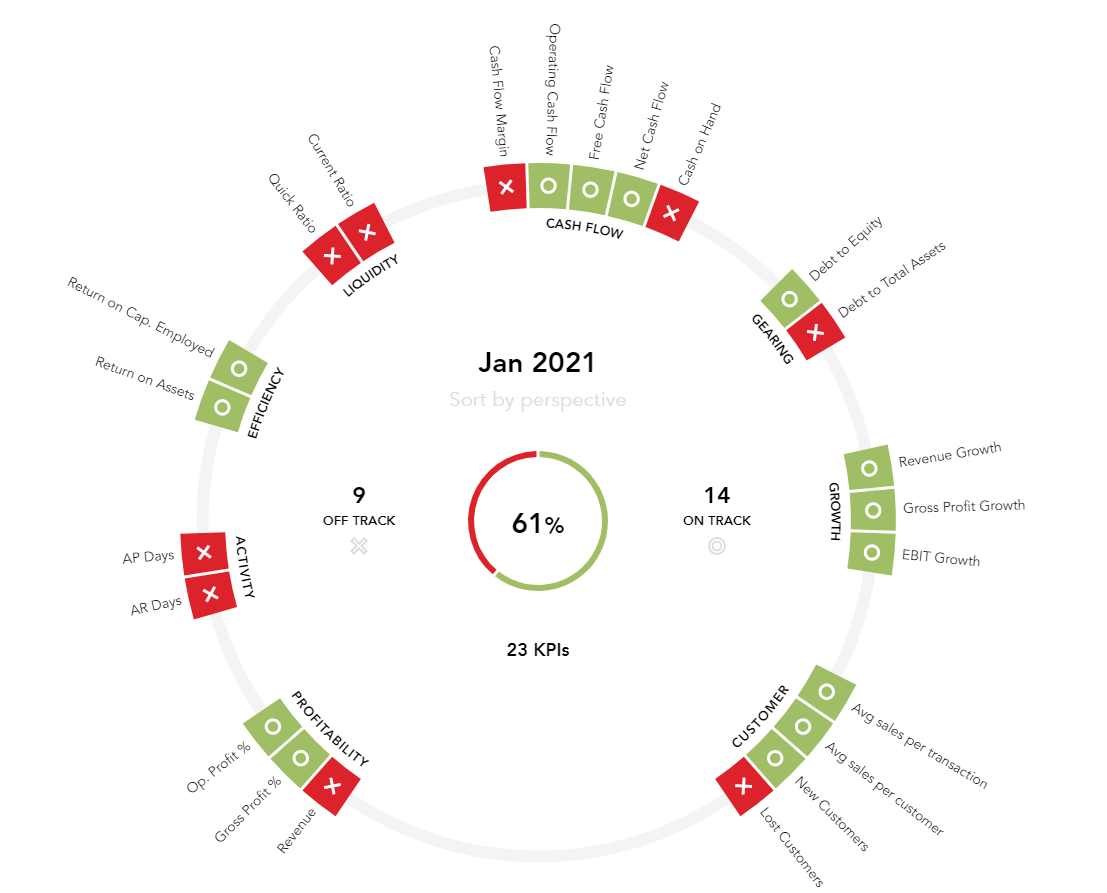

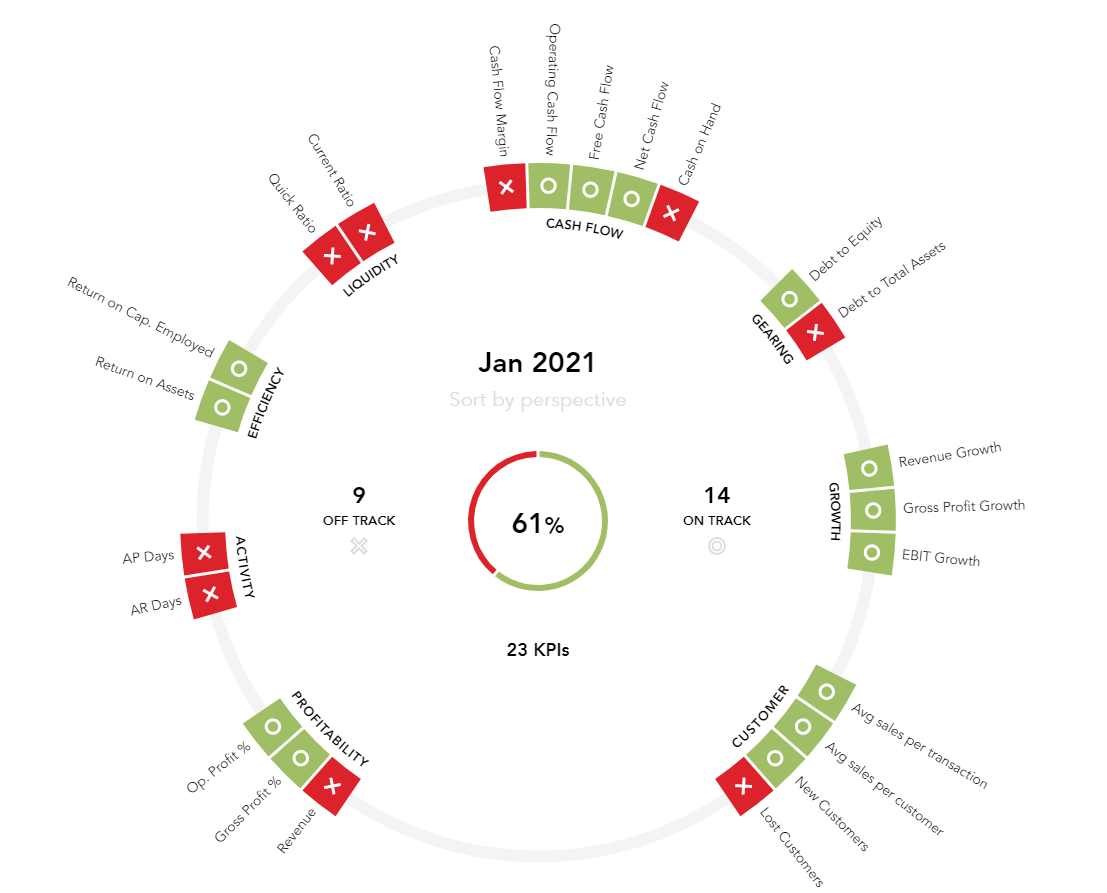

We put together a road map for fixing the broken parts of your business model. This roadmap includes historical trends from your trailing 12 month Profit and Loss (where you’ve come from), a presentation of options and best practices to fix problem areas, and key performance indicators we’ll track with you to make sure you’re making progress.

Step 3

Now it’s time to look forward. We’ll construct…

A 12 month forecast: We plug in your revenue and cost drivers so you can see how they relate to actual revenue, profit and cash over a one-year period. Then we tweak the key levers of your business to help you achieve your long-term goals.

A monthly report tracking your specific KPIs as they relate to your forecasts. Every month we will highlight the areas of improvement needed, how last month tracked to our forecast, and an explanation of the options and possible improvements to be made.

But we don’t just send you a report and leave it at that. You will also have an hour-long monthly call with your accountant to go over your report, highlight the areas that need work, update your assumptions, and track your progress.

You know you need to be “looking at your numbers”. We’ll help you not just look at them, but understand them and most importantly, act on them to make your business grow.

Ready for Pricing?

We have packages for small and large businesses. The next step is a quick call with one of our friendly client advisors