How We Boosted Steveo’s eComm Cash Flow by Six Figures (with one phone call)

By Julia Kelly

Rigits Co-Founder

Who These Strategies Are For

These strategies are not applicable to every business model.

It is tailored for proactive eCommerce owners with consistent revenue who want to increase profitability.

In fact, this is the exact method we implemented to help Steve more than double his profit!

If you’re looking to boost your eCommerce profitability, clarity and cash flow, then THIS is the strategy for you.

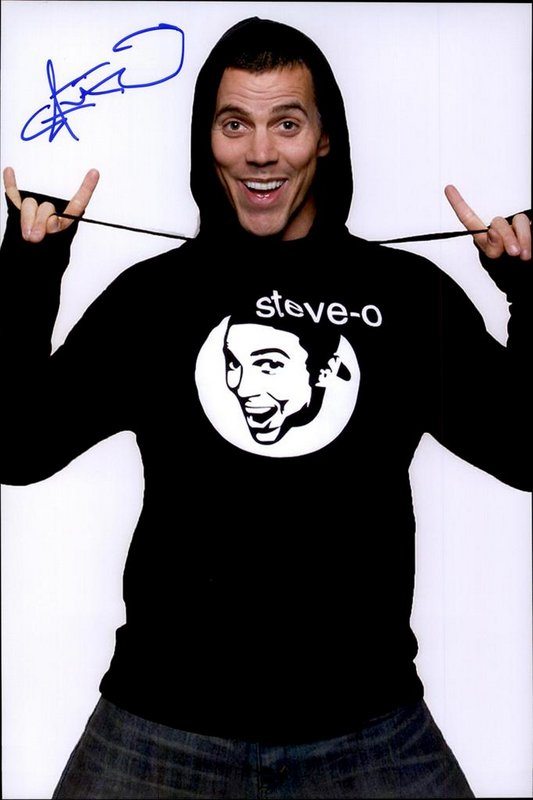

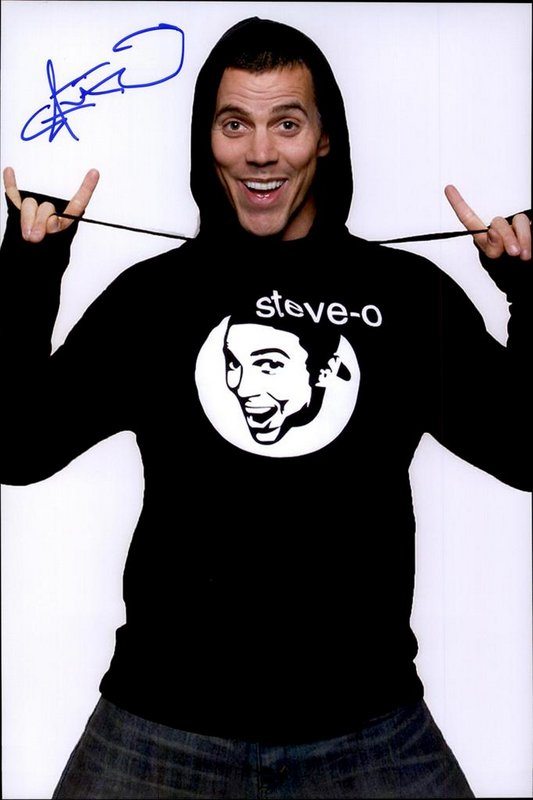

Steveo on the Bucket List tour. Merch is sold online (Shopify) and on tour (Square), so we have multi-channel sales platforms to integrate into his reporting.

The problem and how we approached it

Steve (aka Steveo) was introduced to us through a referral. After a thorough review of his books (which were a mess), we presented our findings and solutions to his team and then got to work. Steve had an eCommerce operation that – despite strong revenues – was struggling to make any meaningful decisions based on financial reports. Ted (Steve’s manager) put it like this:

“Prior to hiring Rigits, the accounting was a mess. Each monthly conference call focused primarily on identifying and correcting basic errors. The accounting reports had little value in actually running the business.”

Ted (Steve’s Manager)

“Accounting had always been done on a cash basis. Large merchandise orders were charged as expenses upon delivery, while the related sales revenues dribbled in over subsequent weeks and months. Because of this and several other limitations, even when the accounting was accurate, the P&L statements were highly misleading.”

Ted (Steve’s Manager)

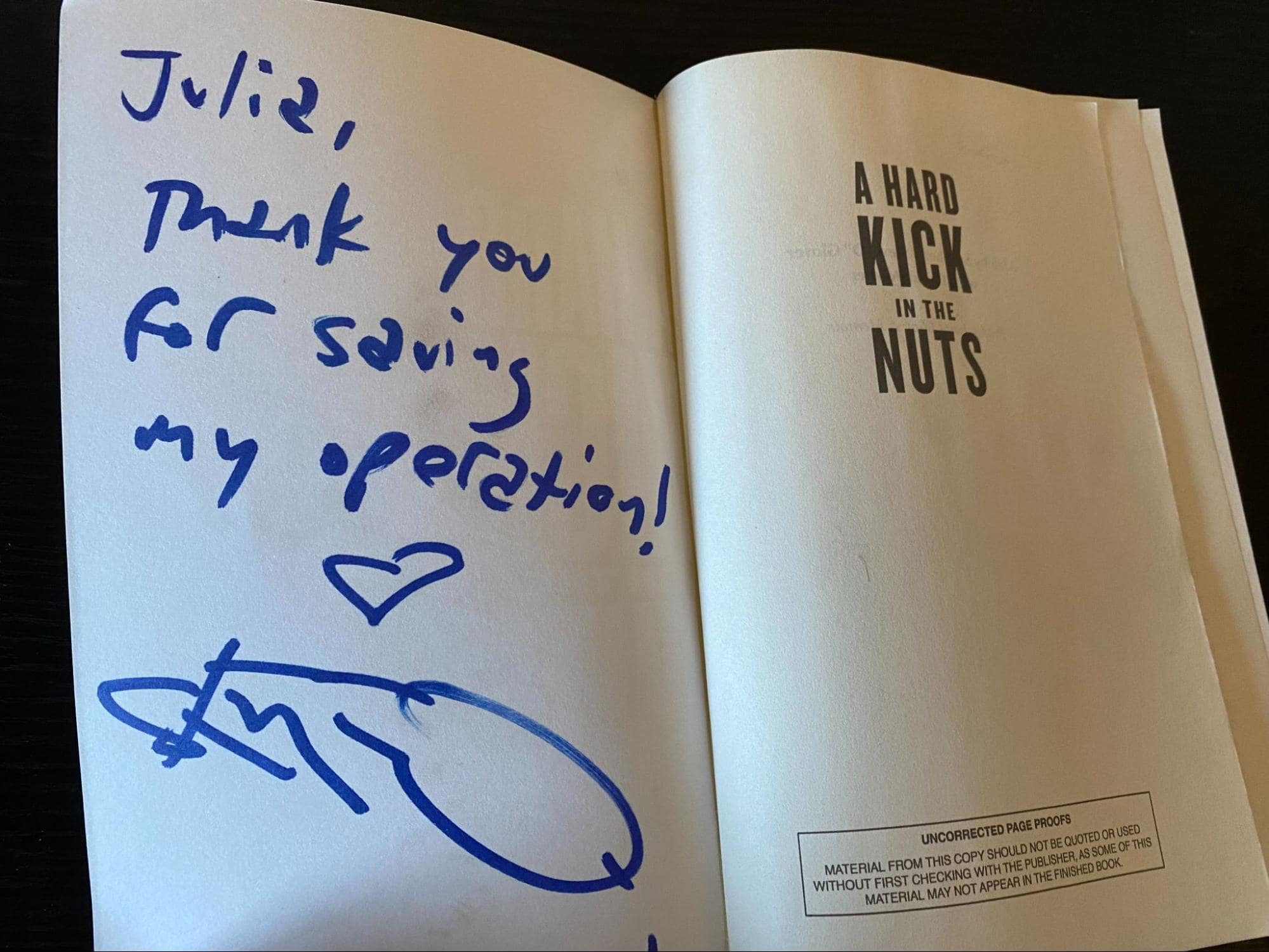

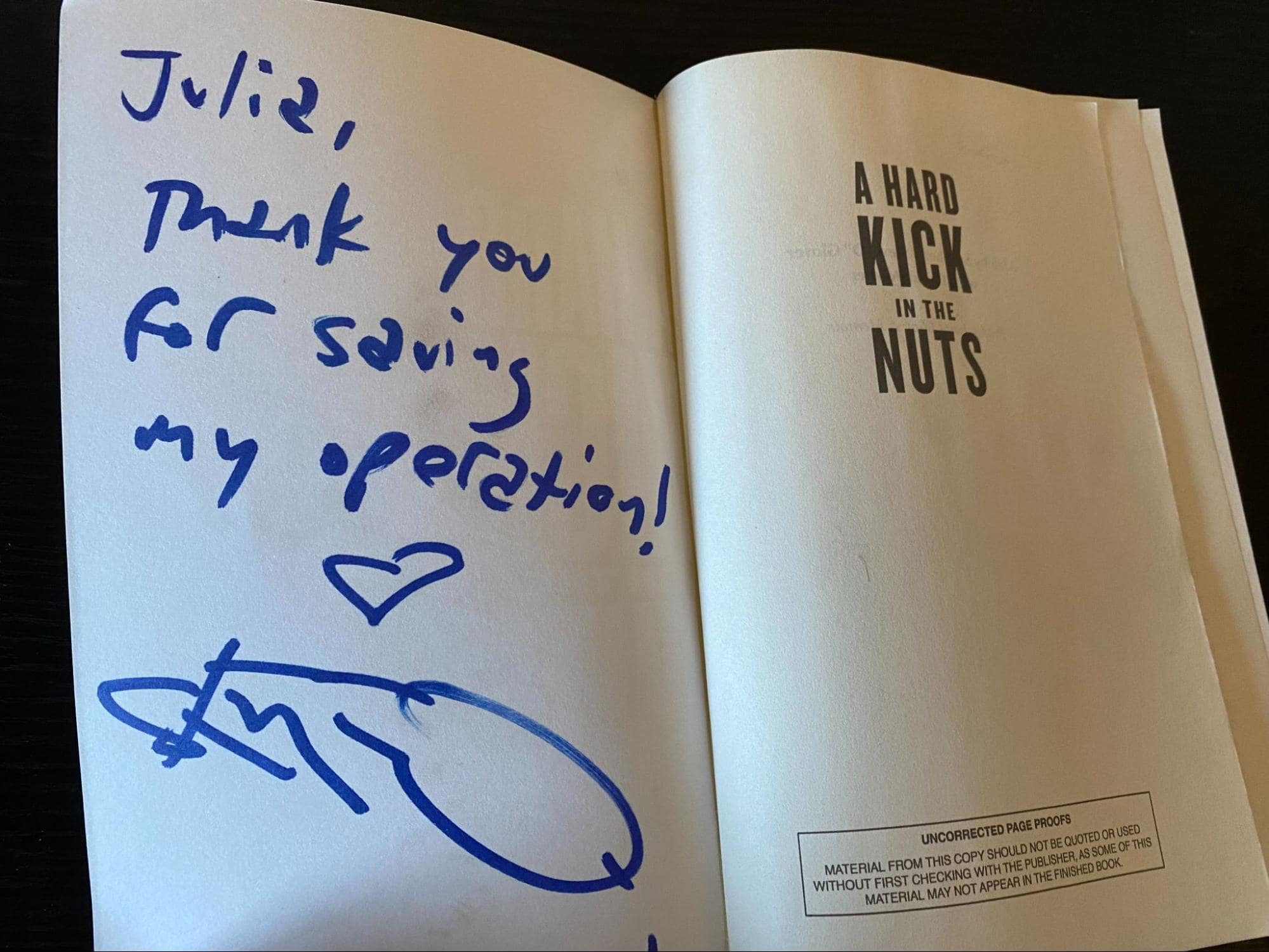

Me and Steve wearing wearing our Rigits shirts 😊

- 1. Clean up the books. This is the low-hanging fruit that covers the bare minimum of reliable financials: proper categorization of income and expenses, auditing asset and liability accounts (and creating backup schedules for clarity & detail), and reconciling accounts.

- 2. Switch to accrual accounting. Once the books were clean and the reports accurate, we prioritized clarity. For an eCommerce operation at this level, cash accounting was not going to cut it. We needed an accrual approach to get the real numbers.

- 3. Get granular. Only after we had accurate and clear financials could we begin to drill down and start uncovering more insights like “what are our highest and lowest margin products?”, “what promotions are worth running?” and “how does in-house fulfillment compare to drop shipping?”

“Now that we have a reliable, accrual based system in place, we can pull out ad hoc reports to analyze individual product segments, and even important SKU's. "Team Rigits" will always go the extra mile. ”

Ted (Steve’s Manager)

So now let’s drill down and see how you can apply these strategies for your own company.

Steve’s autograph on an advance copy of his book❤️

Step 1: Audit (All) Your Sales Data

Pssst: This step is where we found six figures of cash Steve didn’t know he was sitting on.

If you get this wrong: Revenue (probably) undercounted. Refund, sales tax and merchant fees missing. Possibly money hiding in your merchant account.

This is one of the most common mistakes we see – an income account with a bunch of deposits being logged directly as sales. These deposits are typically from a platform like Shopify, Square, WooCommerce, Amazon, or a credit card processor.

The problem is that there’s a whole lot of data that goes into those deposits that will skew your financials if you don’t capture it. For example:

Your merchant processor deposits $50,000 in your account. Here’s all the data that’s missing from your P&L if you log this deposit straight to sales:

- Gross Sales (because your merchant is sending you Net Sales)

- Refunds

- Shipping Income collected

- Sales Tax collected

- Merchant fees

Without this data you’re going to have a misleading picture of your real profitability. But there’s another reason this is so important. Some merchant processors hold back a portion of your sales as “Reserve Funding”.

In Steve’s case, one of his merchant accounts had been holding six figures in cash as “reserve”. We called up the vendor and asked why such a significant amount had to be held in reserve and they told us “no reason, we’ll transfer the funds over.” Because those merchant deposits had been being logged straight to sales, Steve had also undercounted sales by six figures.

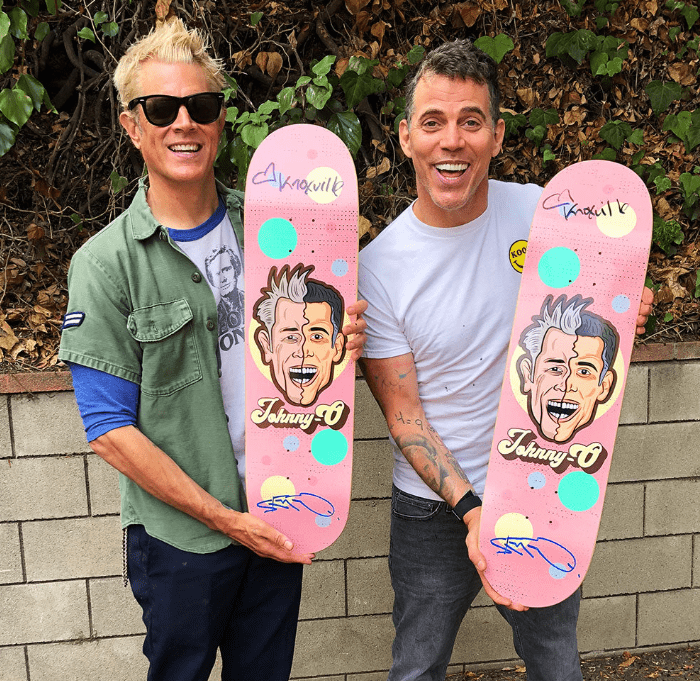

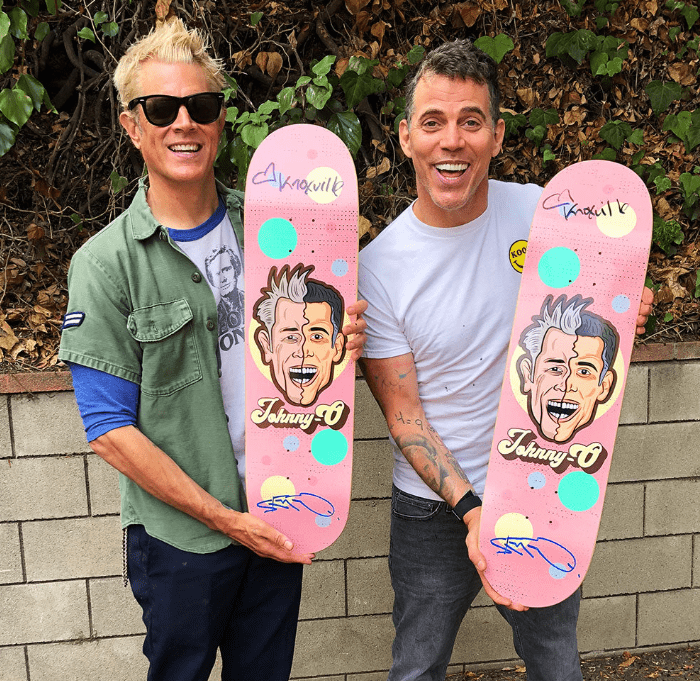

A couple of the co-branded skateboards Steve sells.

3 Ways to Capture Hidden Revenue

There’s three approaches we take to logging sales correctly.

- 1. Pull reports directly from the merchant processor and do a month-end journal entry to log Gross, Refunds, Shipping etc. You can either use a clearing account for the deposits, or log the deposits straight to sales and use the journal entry to true it up at the end of the month. Suggested for Shopify and Square since their reports are easy to find and easy to understand. This is the strategy we use for most of our eCommerce clients.

- 2. Use A2X. A2X acts as a link between your merchant processor and Quickbooks or Xero. As long as you map your accounts correctly during the setup process, A2X will break down every deposit into the correct categories and push all that info to your accounting platform as a journal entry. All you have to do is match the deposit to the journal entry. Recommended for Amazon FBA because without A2X, Amazon reports are very complicated, hard to find, hard to understand, and their support is terrible.

- 3. Use a different integration plugin. Depending on your sales platform, there might be a Quickbooks or Xero plugin that can pull in all your sales data automatically (the same way A2X does). But be careful. Make sure it’s a highly rated plugin (check the reviews!) because a bad or incorrectly mapped plugin can create hundreds (or thousands) of incorrect transactions in your books that are a real pain to delete.

Step 2: Move to accrual accounting

If you get this wrong: So technically cash accounting (the alternative to accrual) isn’t wrong, it’s just much less useful. Cash accounting makes it a lot harder to understand how your business is doing and how profitable you actually are.

In plain language, cash accounting recognizes income and expenses when they hit your bank account. Accrual accounting recognizes income when it is earned and expenses when they are used.

“With Rigits help, we switched all businesses from cash accounting to accrual based accounting and finally had reports that were useful.”

Ted (Steve’s Manager)

Revenue example

Let’s say you run a promotion on July 31 and make 1,000 sales, hooray!

Your merchant processor is going to take a few days to send the money to your bank. So your July sales are deposited in August.

On cash accounting: Your revenue is counted in August, not July. So when you’re trying to figure out if the promotion was a success, you’re going to have to extract those sales from August and move them back to July (either in your head or a separate spreadsheet) so you don’t get your July promotion mixed up with your August sales.

On accrual accounting: Your July sales get logged in July as accrued income. When the money hits your account at the beginning of August, you reverse the accrual. So now there’s no confusion when you’re looking at your July performance – all of July’s sales are captured.

In addition to eCommerce, Steve has touring income which we also log on an accrual basis to get accurate tour profitability numbers.

Expense example

Business is booming so you buy $100,000 of inventory in August.

On cash accounting: The full $100,000 goes directly onto your P&L as Cost of Goods Sold. August is going to look like a really bad month with this huge expense dragging down your profit.

On accrual accounting: That $100,000 goes on your Balance Sheet as an asset (because you own that inventory). You only log Cost of Goods sold when the sale is made. Here’s how it looks:

- You make a sale

- You move the Cost Of Goods Sold (only for the sales you made that month) out of inventory and onto your P&L as COGS. Inventory goes down, COGS goes up.

Now you know your real profitability because your COGS are matched to sales, instead of dumped on your P&L as one huge expense.

Solution: Don’t try this at home – accrual accounting is really easy to screw up. Find an accountant or bookkeeper who (really) knows accrual accounting. If you’re ready to make the switch, make the switch 100% to full accrual because a half cash, half accrual approach is going to be messy, confusing and much less useful.

Step 3: Get Granular

If you get this wrong: Limited understanding of what drives your profitability.

Your eCommerce business is generating thousands (probably millions) of data points – how do you find a signal in all that noise? The big sales channels (usually) give you all kinds of detailed reporting on your sales, but that’s only half the equation – what about costs? Here’s some examples of the types of metrics eCommerce companies typically track and how they can be much more useful when costs are factored in.

LTV and CAC: Most eCommerce companies have at least a high level understanding of the Lifetime Value (LTV) and Customer Acquisition Costs (CAC) of their customers. But do you know your lifetime profitability per customer and does it vary by product sold? You have to factor in all your costs to find which relationships are genuinely beneficial to your bottom line.

Promotions, Commissions and Affiliates: By comparing your promotions and sales data against variable costs (like COGS, shipping, etc.), you can identify which promotions are worth pursuing. For instance, is that 20% off sale driving enough purchases to cover the discount, ad costs, COGS and still provide a healthy profit? Are you paying affiliate fees or commissions on your low margin products and is it worth it?

Inventory costs: Has the cost of every SKU in your inventory stayed the same, or is there variance? Inventory can be a silent killer when it comes to profits, especially if costs vary. Analyzing varying inventory costs can help you pinpoint if your margins have changed over time, and which SKUs might be draining your resources.

Steve sells a mix of high and low-margin products that require different inventory and sales analysis.

Solution

Here’s our general approach to wrangling actionable insights from several different sources.

- Start with just one profitability metric that you think will move the needle the most.

- Collect your sales data. If you’re using one of the big platforms (Shopify, WooCommerce, Amazon FBA), you will have a wealth of reporting on your sales.

- Collect your cost data. To start with, it’s usually most efficient to focus only on COGS and not worry about fixed costs yet. However, there are usually costs that don’t strictly fall under COGS that you’ll want to factor in like affiliate payments and commissions, advertising (sometimes), or any cost that can be directly traced to sales. This is usually the trickier part and you’ll likely have to pull from several sources.

- Put it all together. If you’re looking at thousands of sales, don’t go overboard with mapping every cost to every sale perfectly (unless you have experience in data science or love spending hours inside Excel). Use averages, group by product type, and categorize expenses in buckets. Start with the 80/20 rule – a general trend based on reasonably accurate numbers will be much more efficient than getting every single datapoint 100% precise.

Now You Try It

Unless you’re going the venture funding route, profitability is paramount in your eCommerce biz. But just looking over your Profit & Loss every once in a while is not going to get you there.

Your financial reports need to be:

- Accurate

- Understandable

- Granular

Once you have that kind of reporting, you can start taking action to maximize your profitability. At Rigits, we tackle these three steps in order. It doesn’t happen overnight, but each step builds on the other to create a roadmap to a better, fatter bottom line.

To get started, swipe our eCommerce profitability troubleshooting guide with questions you can simply copy/paste and email to your bookkeeper or accountant. These questions will determine how accurate, clear, and granular your data is and where you might be losing money.

As a second step, you can send me their answers and I’ll help point out any red flags or areas to investigate.

Get your email template below, then tailor your approach to build your own roadmap to success!

If you’re wondering if you’re leaving money on the table, the first step is asking your accountant or bookkeeper the right questions.

Download our email template with questions you can modify to your business.

Want this all done for you?

You can implement all these steps yourself, or we can do it for you.

We work with eCommerce (and other kinds of) companies who use (or are willing to switch to) Quickbooks Online and who are ready to invest in accurate, clear, and granular reporting.

“Communication and support is excellent. On a number of occasions, conference calls have dragged on far beyond normal business hours without complaint. Email requests always receive timely responses. If for any reason target delivery dates can't be met, there's always a justifiable reason and we're always notified well in advance.”

Ted (Steve’s Manager)

We’ll start with discussing your general goals and where you think you might be leaving money on the table, then we’ll conduct a detailed audit of your books and workflows. After that, we’ll lay out your customized roadmap that aligns with your profitability goals.

And if you want to start enjoying peace of mind and concentrate on your core strengths instead of getting bogged down in spreadsheets, we’ll handle the implementation of your roadmap for you – right away.

About author

Julia Kelly

I am the co-founder of Rigits. I majored in Accounting at San Diego State University.