Let me explain how we did it…

Over the last 8 years, we’ve used our UMM Strategy to help dozens of business owners (including Steve-O):

- Eliminate financial confusion by effectively organizing their books

- Gain an accurate view of profitability by showing them their REAL numbers

- Take charge of their cash flow by tracking the movement of every single cent

Scott Randolph, Tight Box Packing

Since we’ve been with Rigits our company projections and clarity on long term goals have become crystal clear. We were with a top New York agency for the last 20 years and when we made the transition to working with Rigits, it made us realize how much we have been missing out on.

I wish we found them sooner!

Ross Nelson, Beacon’s Point

I worked with the Rigits team for about 3 years as a co-owner of a marketing agency. Julia and Elizabeth were the first bookkeepers we used that took an active interest in helping us see how managing our books differently could help our company improve financially.

Rigits worked with us to restructure our P&L to bring more clarity to our revenue streams and costs, and how to improve our profits. They also helped with establishing and tracking a variety of KPIs to monitor the health of the business and achieve new goals.

We eventually sold the business and had a lot of confidence in negotiations and setting our company’s value because of those metrics. It’s definitely a great place for any business to be knowing that your books and financial statements are rock solid.

Helen Chang, Author Bridge Media

I had the privilege of working with Rigits to look over at our strategy and numbers. Julia was clear, concise, and gave great guidance. She’s a great coach and she knows her stuff. I highly recommend them, you won’t go wrong with Rigits!

But it MAINLY works for businesses that generate at least $1M in revenue and are PROFITABLE.

If you are NOT profitable and NOT generating AT LEAST $1M annually, you may not get the best results.

Now, if you ARE… then pay close attention to every word on this page.

UMM solves 3 big problems for business owners trying to become confident and proactive in their finances:

“My financials don’t make sense”

Do your financial statements confuse you and your team? Are they unhelpful (or even actively detrimental) in guiding your business decisions?

The Solution: A strategy that gives you financial clarity. UMM was created around the core concept that clarity and understanding unlocks financial decision making.

“I know we’re profitable – so where did all our money go?”

Are you struggling to cover immediate expenses despite turning a profit? Does that lack of on-hand cash confuse you?

The Solution: A strategy that gives you a clearer picture of your cash flow. A fundamental outcome of UMM is a better understanding of where your money is going, and why.

“We’re always reacting instead of looking forward”

Is your financial team always making reactive, short-term decisions? Do you struggle to build an accurate long-term view of your business finances?

The Solution: A strategy that allows you to look ahead with confidence. UMM builds a financial foundation that allows your decisions to align with long-term profitability.

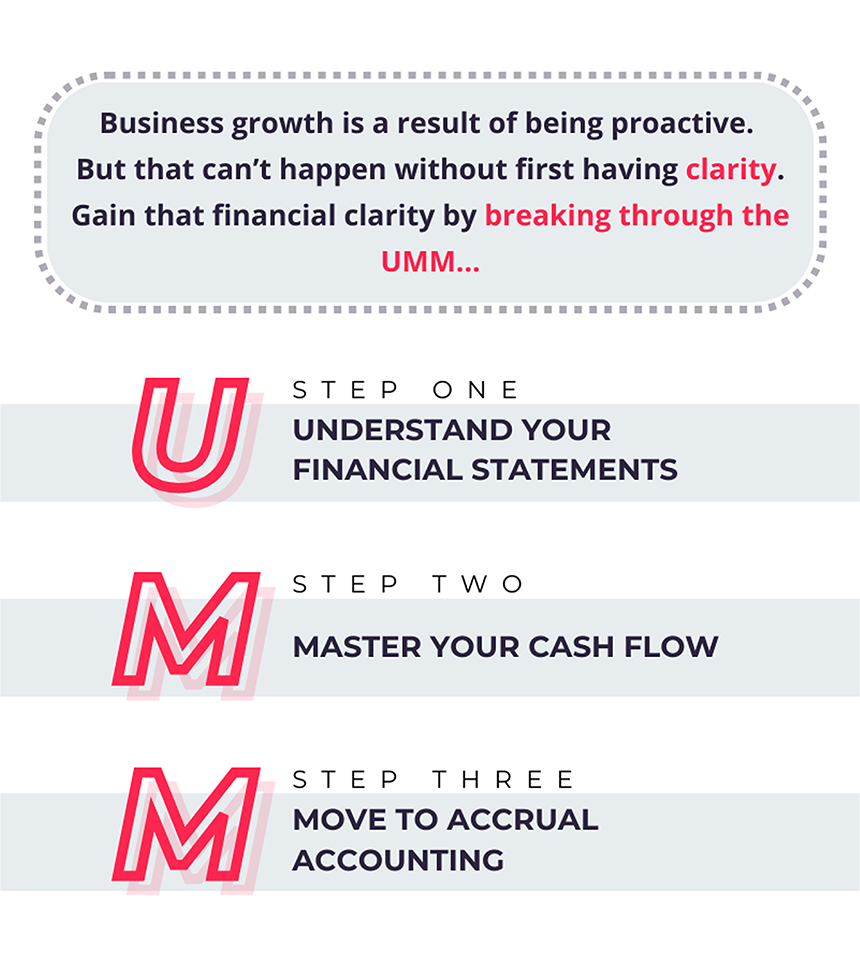

All you need is to break through the UMM…

Being financially confident and proactive first requires clarity. Without it, thinking about your business finances is just one big “umm…”

This strategy is designed to bring you the clarity you need by smashing through the UMM, one letter at a time.

After doing this for 8+ years, here’s what we’ve found works best:

The UMM Strategy

Our UMM Strategy provides that financial clarity in just three simple steps. It goes a little something like this:

Here’s what each of those steps look like in action (and how you can replicate this strategy for yourself):

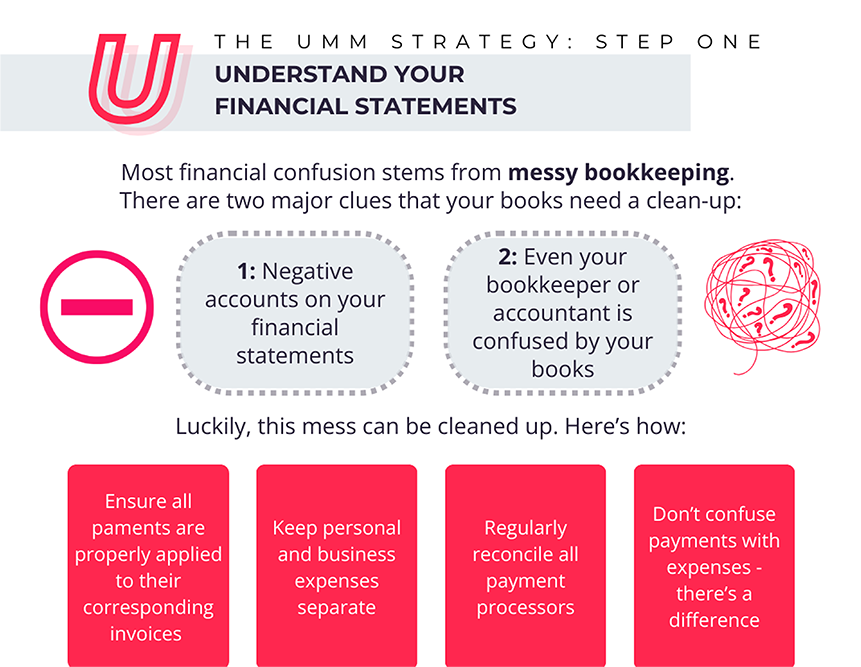

Step One: Understand Your Financial Statements

The biggest financial roadblock that I see with clients is not understanding their Profit and Loss or Balance sheet.

You need a crystal clear understanding on every account that shows up on these two reports. Without that, you (and your business) are flying blind.

This lack of understanding almost ALWAYS comes back to messy bookkeeping – basically, things are not where they should be.

But first, you need to actually figure out whether you have any issues. This is pretty easy to do – there are two major red flags that indicate your books need a clean up:

- Negative accounts on your financial statements. There ARE a couple of accounts that should be negative, but 90% of the time, it spells trouble.

- It confuses those who should understand. Go through your P&L and Balance Sheet, and note everything that doesn’t make sense to you. Bring those notes to your bookkeeper, CPA, or even a financially-savvy friend, and have them explain it to you – if even they are stumped, time to get cleaning.

So, what does “messy” even look like? Here’s some of the more common manifestations of messy that I see with clients (and how to fix them):

PROBLEM #1: Messy AR

Payments not properly applied to invoices won’t always show up as income.FIX: Regularly reconcile your accounts receivable by ensuring all payments are accurately applied to their corresponding invoices.

PROBLEM #2: Personal expenses mixed in with business ones

This skews your net profit – potentially by quite a big margin, depending on your level of expenses.FIX: Keep your personal and business expenses separate. If you must have personal expenses coming out of your corporate accounts, keep them strictly in a Owner’s Draw equity account.

PROBLEM #3: Payment processors not reconciled

Many payment processors function similarly to banks – but often they’re never reconciled. There could be many thousands of dollars unaccounted for in those portals if you’re not reconciling them.FIX: Regularly reconcile all payment processors to ensure every transaction is accounted for and properly recorded in your financials.

PROBLEM #4: Stuff in expenses that belong in liability accounts

Loan payments are not expenses. Neither are credit card payments, sales tax payments, nor some kinds of employee benefit payments (health care, retirement etc.).FIX: Understand the difference between expenses vs payments, and make sure you don’t mix them up when logging them.

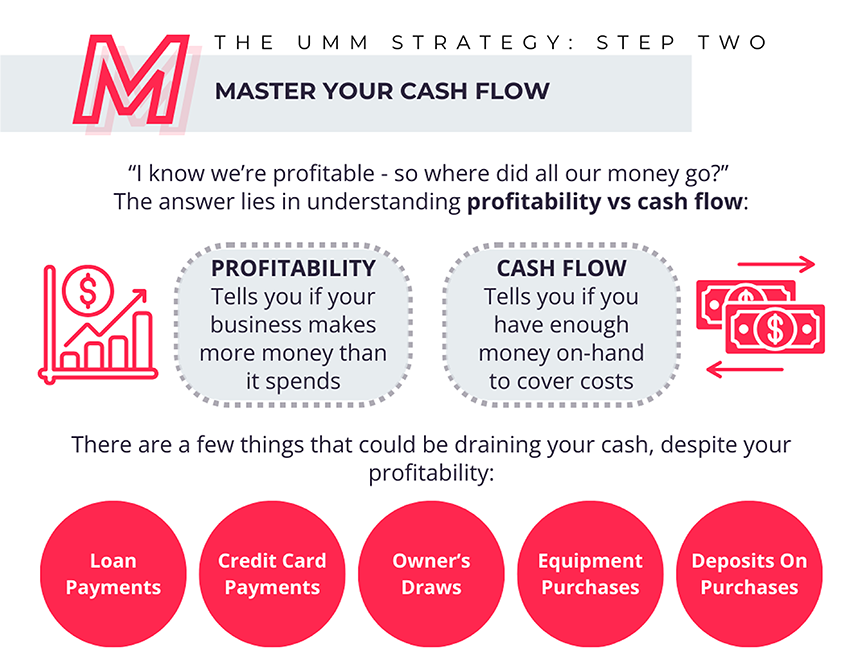

Step Two: Master Your Cash Flow

Speaking of understanding differences…One of the most common accounting misunderstandings is profitability vs cash flow.

Speaking of understanding differences…One of the most common accounting misunderstandings is profitability vs cash flow.

If you know that you’re profitable, but you’re stuck wondering where all of your money went, understanding the difference between the two will give you some good insight:

PROFITABILITY:

- Tells you if your business is making more money than it spends

- Looks at overall financial performance over a period of time

CASH FLOW:

- Tells you whether your business has enough money on-hand to cover immediate expenses

- Shows the movement of money on a daily basis

You can be profitable, while still struggling with cash flow (and vice versa). For a clearer view of your cash flow, you need to factor in ALL of the ways that cash is going out the door – not just expenses.

There are a few things that could drain your cash but won’t necessarily show up on your profit and loss:

- Loan payments

- Credit card payments

- Owner’s draws (money you take out of the business)

- Equipment purchases

- Prepayments or deposits on purchases

Once you have a clear understanding of cash flow patterns, then you can start forecasting.

Cash flow forecasting is a vital tool for financial decision making and future planning. It helps you:

- Understand how future plans will affect your cash – if you were to hire another employee, buy more equipment, or acquire another company, how would this affect your cash?

- Model out best, middle, and worst case scenarios – for example, “what’s our contingency plan if that customer who’s been ignoring us for months never pays their invoice?”

- Map out your runway – you can easily figure out how many months you could fund operations if your revenue dried up tomorrow.

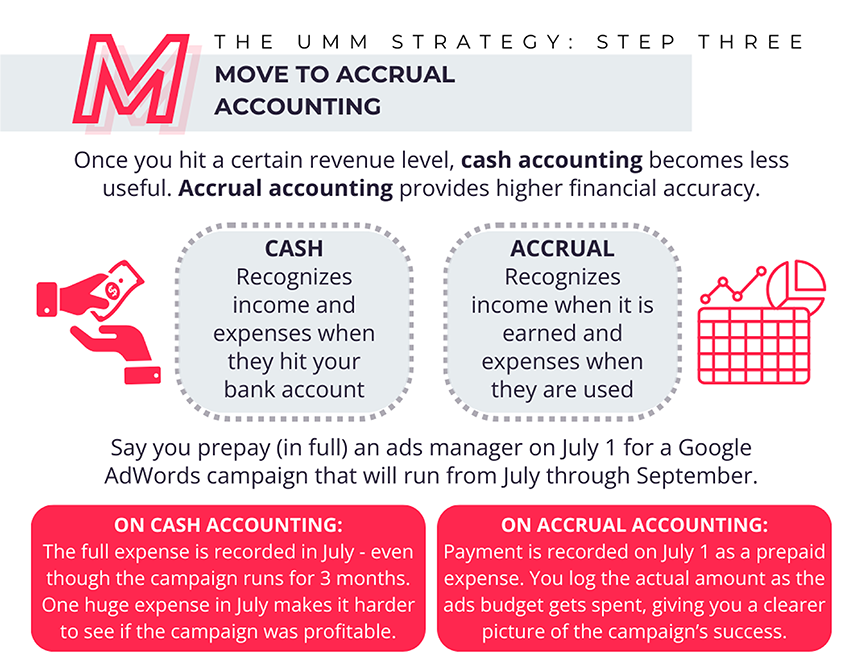

Step Three: Move To Accrual Accounting

For most businesses at the $1m ARR level (and beyond), cash accounting just doesn’t cut it. Plain and simple.

Accrual accounting, on the other hand, works fantastically. It allows you to see your real numbers with miles more clarity.

Now, cash accounting isn’t WRONG per say – it’s just less useful once you hit a certain level.

It’s great when you’re a smaller operation. But as your revenue increases and your business grows, your finances become more complex; the weaknesses of cash accounting make themselves known pretty quickly.

With all that being said, I typically suggest that most of my clients transition to accrual accounting – but why?

Well, in plain language…

CASH ACCOUNTING: recognizes income and expenses when they hit your bank account.

ACCRUAL ACCOUNTING: recognizes income when it is earned and expenses when they are used.

To further illustrate this, here’s a real-world example of cash vs accrual head-to-head:

THE SCENARIO

Let’s say you prepay an ads manager on July 1 for a Google AdWords campaign that will run from July through September.

You fund the AdWords account the full amount upfront, but the campaign will span three months, generating results over time.

On cash accounting…

Since you paid the full amount in July, the full advertising expense is recorded in July – even though the campaign is set to run through September.

So it’s hard to figure out if the campaign was a success because you have one huge advertising expense in July, but your sales are coming in over three months. Was it a profitable campaign? Harder to tell…

On accrual accounting…

You record the prepayment on July 1 as a prepaid expense. Then as the budget gets spent, you log the actual amount spent on the ads in each month as advertising expense.

This way, when you’re checking each month’s performance, the campaign costs match up with the revenue and results each month, giving you a clearer picture of how the campaign is actually doing.

Accrual gives you a much more accurate picture of both your profitability AND your cash flow, allowing you to make better informed financial decisions that will actually drive growth.

To summarize…

Financial clarity is the first step to proactivity (i.e. continued business

growth and profitability). Gaining that clarity requires you to break

through the UMM:

Understand your financial statements and clean up your books.

Master your cash flow for better future planning

Move to accrual accounting for a more accurate view of your profitability

There are a few reasons why the UMM strategy works:

- It gives you financial clarity. A fundamental concept of UMM is understanding – something that far too many business owners lack when it comes to their finances.

- It provides accuracy. Ironing out the kinks in your bookkeeping and accounting lets you act on numbers that are a bit (a lot) more grounded in reality.

- It lays the groundwork for profitable growth. Clarity + accuracy = proactivity. UMM gives you the tools to make big business moves – now, and into the future.

But don’t just take my word for it – here’s what UMM has done for more of our clients:

Solved a year of bookkeeping and accounting issues in under 5 hours:

Kevin Espiritu - Epic Gardening

Rigits solved a year of bookkeeping and accounting issues in about 4-5 hours. Previously I’d spent untold amounts of energy and time thinking about it when it is CLEARLY not my forte. Hiring them was the biggest no-brainer expense I’ve ever had in business.

From books 6 months behind to up-to-date in just a few weeks:

Tim Koezler, EquiBrand Consulting

Our books were about six months behind when Rigits took over. In a few weeks we were back up-to-date with financial statements that my long-time CPA was very happy with. It’s incredibly valuable to have bookkeepers with a thorough knowledge of both accounting and Quickbooks. The team at Rigits are true professionals and I highly recommend them.

From self-managed Quickbooks mess to neat and organized:

Paris Buchanan, A&P Branding

I had been trying to manage my bookkeeping myself for about a year. It was impossible to keep everything organized on top of running our business and doing client work. My Quickbooks file was a complete mess – I was pretty sure no one would want to touch it!

The Rigits team tackled it though! They organized our data, cleaned up our balance sheet and keep us on track every month. I don’t have to worry about paying my contractors, logging receipts, sorting transactions or filing our quarterly reports. I love knowing that we’re in good hands and our books are being done right!

But the best thing about the UMM strategy is the simplicity.

It takes the seemingly-complex task of gaining financial clarity, and breaks it down into steps that even the most financially un-savvy can get done.

Time and time again, I’ve seen UMM take business owners from financially overwhelmed to financially organized – just like it did for Steve-O and his crew:

Steveo - Jackass

In the first month of working with us, Rigits cleaned up all the mess and found over $100,000 of cash I was sitting on that I didn’t even know about. Since then we’ve switched from cash to accrual accounting so I can actually see what’s really going on with my businesses. I’m more productive and more profitable than ever and I want the whole world to know it’s because of Rigits, and I love them. They’re the best!

If you’d like to see how we can help you get the financial clarity and confidence you need… you have two options:

Option 1

You can take the steps I’ve laid out here today, and try to implement the UMM strategy for yourself.

Honestly, it can get tricky – especially moving to accrual accounting (that can be easy to mess up if you’re inexperienced).

BUT even a DIY job will mean you’ll be saying “umm…” much, MUCH less.

Option 2

You can work 1-on-1 with us here at Rigits. Take wasted time, endless stress, and lost money out of the equation by bringing us on board.

We’ll completely take care of your bookkeeping, accounting, payroll, forecasting and financial analysis – giving you the financial clarity and confidence you need to be proactive, without the headache of figuring it out on your own.

We will:

- Get your bookkeeping humming along in the background without needing your constant attention

- Allow your payroll & billpay to put you in control without being in the weeds

- Organize your financial statements to give you full clarity, not confusion

- Ensure your cash flow forecast give you confidence

- Help you create a financial future that excites you!

Ready to get started? Book a FREE consultation call below!

Click the button below to book a call with me, Julia.

On our call, we’ll establish a clear picture of where you are and where you want to go. You’ll tell me what your biggest financial roadblocks are, and what clearing them would do for your business.

I’ll start filling in the blanks, and show you what the journey from financial confusion to clarity and proactiveness would look like for you.

It’s a journey that I’ve been a part of for over 100 business owners, and I’d love to be there for yours too. Click the button below to take your first step. Talk soon!