This article will explore the nuances of direct deposit, including how it works and can be used effectively, and the ways it can benefit your business.

This guide is also related to our articles on 13 best payroll software, apps & tools in 2023, 15 best payroll books to read in 2022, and online bookkeeping services for small businesses.

- Direct deposit advantages

- Setting up direct deposit

- Direct deposit for small businesses

- Benefits of electronic payments

- Managing payroll systems

Let’s get into it!

Understanding direct deposit

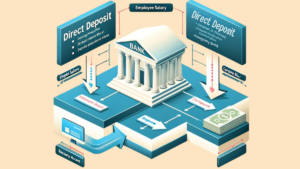

Direct deposit is an electronic payment method where funds are transferred directly into a recipient’s bank account. Unlike traditional payment methods, such as checks, direct deposit streamlines the transfer process and eliminates the need to physically handle cash.

Here’s how it typically works: a payer, like an employer or government agency, issues an electronic instruction to their bank to transfer a specified amount of money. The bank then electronically forwards this amount to the designated recipient’s bank account. This process speeds up the payment arrival and minimizes the risks associated with lost or stolen checks.

Where is direct deposit used?

The real question is probably where isn’t it used–you’ll find it used across various sectors and for a multitude of payments. Here are some common ones:

- Employee salaries: One of the most frequent uses of direct deposit. Businesses of all sizes find it efficient for payroll because employees receive their wages promptly and securely on payday without the need for physical check distribution.

- Tax refunds: The IRS and other tax authorities often encourage taxpayers to receive their refunds via direct deposit. This method is quicker than mailing a check and lets recipients access their funds faster.

- Investment redemptions: When investments mature or dividends are paid out, direct deposit can be used to transfer these amounts directly into your bank account without the need for manual deposits.

- Payments from retirement accounts: For retirees receiving regular distributions from their retirement accounts, direct deposit provides a reliable and convenient way to receive funds.

- Government benefits: Social Security benefits, veterans’ benefits, and other government assistance programs commonly use direct deposit.

- Rental income: Landlords may opt for direct deposit to collect rent payments, reducing the hassle of handling checks each month and improving cash flow management.

- Commissions: For sales positions or contract work where commissions are earned, direct deposit allows for quick and straightforward payment processing.

- Child support payments: Direct deposit makes child support payments as easy and seamless as possible.

There’s little in the world of payments that direct deposit can’t make a little–or a lot–easier.

Setting up direct deposit: a step-by-step how-to

Setting up and running direct deposit in your business is a straightforward process, but there are a few steps involved. Here’s a walkthrough to help you when using it for payroll–from initiating setup to the final deposit into an employee’s account.

Choose a direct deposit service

First, you’ll need to select a direct deposit service. This could be through your existing bank or a third-party provider that handles payroll processing. When picking a service, compare fees, reliability, security features, and ease of integration with your current systems.

Collect employee banking information

To set up direct deposit for an employee, you’ll need their bank account details. This includes the bank name, account number, and routing number. Make sure you have a secure system for collecting and storing this sensitive information to protect your employees’ privacy.

Obtain employee authorization

Before you can deposit funds into an employee’s account, you need their consent via a signed authorization form. This form typically confirms that they have provided accurate banking details and allows you to deposit money into their account.

Enter details into your payroll system

Once you have all necessary permissions and information, enter this data into your payroll software. If you don’t use software, your bank or third-party provider can guide you through how to submit this information for processing.

Run a test transaction

Before fully implementing direct deposit, it’s wise to run a test transaction to ensure everything works smoothly. This can prevent errors on a larger scale and helps to identify any issues early on.

Schedule the payments

With direct deposit, you can schedule payments in advance, which is especially useful for regular and recurring transactions like payroll. Set up the payment amounts and the dates on which they should be deposited.

Funds are transferred from your account

On the scheduled payday, your bank or the third-party service will withdraw the total payroll amount from your business bank account. This process usually begins a few days before the actual payday.

Employee accounts are credited

After the funds are withdrawn from your account, they are electronically transferred to the employee accounts specified in your payroll. It typically takes one to two business days for the funds to clear and appear in the employees’ accounts, depending on bank processing times.

Confirmation and records update

Once the process is complete, you should receive a confirmation from your bank or payroll service. Make sure to update your payroll records accordingly and provide pay stubs to your employees to confirm the amount deposited and any deductions taken.

Maintaining the system

To keep things running smoothly, regularly verify that all banking information is up-to-date and that your payroll software or service is functioning correctly. Adjustments might be necessary when employees open new bank accounts or when there are changes to bank policies or fees.

Benefits of direct deposit for businesses

Setting up a new system takes time and effort, of course, and you may wonder: is it worth it? Absolutely! There are a lot of pluses; here are some of them.

Time savings and reduced administrative burden

Direct deposit significantly cuts down on the time it takes to manage payroll. You no longer need to print checks, sign them, and then distribute them manually to your employees. With direct deposit, the entire process is automated, saving you hours every pay period. Direct deposit also reduces the likelihood of errors in payment amounts and eliminates the possibility of checks being delayed or lost in the mail.

Enhanced security compared to physical checks

Using direct deposit enhances the security of your financial transactions. Physical checks can be lost, stolen, or even forged, exposing your business to potential fraud. Direct deposit transfers funds electronically and securely, directly from your bank account to your employees’ accounts, minimizing the risk of unauthorized access.

Improved employee satisfaction and retention

Offering direct deposit can be a significant factor in improving employee satisfaction and retention. Employees generally prefer direct deposit because it provides immediate access to their earnings without the need to deposit or cash a check. They don’t have to worry about going to the bank during business hours or waiting for a check to clear.

Compliance with local and national regulations

Stay informed about the regulatory requirements affecting direct deposit. These can vary by location and include rules about employee rights and data protection. Compliance is crucial not only for legal operation but also for maintaining trust with your employees.

Tips for a smooth transition from traditional payroll processes

- Communicate clearly: Keep your employees informed about the change to direct deposit. Explain the benefits, how it works, and what they need to do.

- Provide support: Offer assistance during the transition. Be ready to answer questions and address any concerns that arise.

- Monitor and adjust: After implementing direct deposit, monitor the process during the initial months. Be prepared to make adjustments as needed to address any issues or feedback from employees.

Answering questions employees might have about direct deposit

When you introduce direct deposit as the new payment method, employees will likely have questions about how it works and what it means for them. Be prepared to answer clearly and concisely. Here are some common questions with straightforward answers you can provide:

What is direct deposit?

Direct deposit is an electronic method used to deliver your salary directly into your bank account, replacing traditional paper checks. This process is safe, fast, and convenient, so your pay will arrive on time every payday.

How do I set up direct deposit?

To set up direct deposit, you’ll need to provide your bank account details, including the routing number and account number, and sign an authorization form allowing me, your employer, to deposit funds directly into your account. All necessary forms and instructions will be provided.

When will I receive my pay through direct deposit?

Your pay will be deposited into your bank account on the usual payday. One of the benefits of direct deposit is that funds are often available sooner than they would be with traditional checks.

Is direct deposit safe?

Yes, direct deposit is very safe. It reduces the risk of lost or stolen checks and eliminates the possibility of someone else cashing your check. Banks use advanced security measures to protect electronic transactions.

Can I split my paycheck into different accounts?

Many direct deposit programs allow you to divide your paycheck into multiple accounts. For example, you might choose to have part of your salary go directly into a savings account while the remainder goes into your checking account. Check what options are available.

What happens if I switch banks?

If you switch banks or want to change the account where your salary is deposited, you’ll need to update your banking details. Provide your new bank account information and complete a new authorization form promptly so that your pay is redirected to your new account without interruption.

Will I still receive a pay stub?

Yes, you will still receive a pay stub, either electronically or in paper form, depending on standing procedures. Your pay stub provides details about your earnings, taxes, and other deductions.

What if there’s a mistake with my direct deposit?

If you notice a discrepancy or don’t receive your deposit, contact our payroll department immediately. They can help to quickly resolve issues such as incorrect amounts or missing payments.

How do I check my direct deposit?

You can verify your direct deposit by checking your bank account balance on payday. Most banks also offer mobile or online banking, which lets you see your account balance and recent transactions in real-time.

Managing direct deposit

While direct deposit systems are typically reliable, issues can occasionally arise, like bank errors or changes in employee bank details. Be ready to respond promptly, should the need arise.

- Bank errors: If there’s an error in the amount deposited, or if a deposit goes to the wrong account, contact your bank immediately. Make sure your payroll team is equipped to handle these situations swiftly by maintaining a direct line of communication with your bank.

- Changes in employee bank details: Regularly remind employees to report any changes in their bank details as soon as possible. Make this process simple and confidential, possibly through an online form or a secure email. When you receive new banking details, update the system immediately to prevent payment delays.

Updating payroll software and systems

Keeping your payroll software updated is crucial for the smooth functioning of direct deposit. Make sure you’re on top of the following:

- Regular updates: Is your payroll software up to date? Software providers often release updates that enhance security and add new features that can improve the efficiency of direct deposit transactions.

- Backup systems: Maintain backups of your payroll data to prevent data loss in case of software failure. Consider using cloud-based services that offer automatic backups and high-level security.

- Integration checks: Regularly check that your payroll system integrates well with other HR systems and banking software. Proper integration helps in automating the entire process, from calculating payrolls to transferring funds.

Conclusion

Direct deposit offers benefits that can streamline your payroll process and enhance security. By automating salary payments, you save significant time each pay period, reduce administrative burdens, and minimize the risks associated with handling physical checks

Advantages:

- Time savings: Automating payroll cuts down on manual processing time.

- Enhanced security: Reduces the risk of check fraud and lost or stolen checks.

- Employee satisfaction: Provides employees with immediate access to their earnings, enhancing their overall job satisfaction.

Considerations:

- Set-up: Involves choosing a reliable bank or third-party provider, collecting and managing sensitive banking information securely, and making sure all financial regulations are complied with.

- Maintenance: Requires regular updates to payroll software and training for HR personnel to manage the system effectively and address any issues promptly.

Next, check out our articles on mastering accounts payable, crafting an effective price increase letter, and what are back office services.

FAQ: What is Direct Deposit in Payroll?

Here's some answers to commonly asked questions about What is Direct Deposit in Payroll?

What is direct deposit and how does it work?

Direct deposit is an electronic payment method that automatically transfers funds into a recipient’s bank account. Typically used by employers to pay salaries, it’s also used for tax refunds, government benefits, and other financial transactions. The process involves the payer, such as an employer, sending an electronic instruction to their bank. The bank then securely transfers the specified funds to the employee’s or recipient’s bank account, often making the funds available faster and more securely than traditional check payments.

Who can benefit from using direct deposit?

Direct deposit is beneficial for anyone who receives regular payments and values convenience and security. This includes employees receiving salaries, landlords collecting rent, retirees accessing pension or Social Security benefits, and taxpayers receiving refunds. It’s advantageous for businesses of all sizes as it simplifies the payroll process, guarantees timely payments, and reduces the administrative burden associated with manual check processing.

What do I need to set up direct deposit?

To set up direct deposit, you’ll need to choose a service provider either your bank or a third-party payroll service. You’ll also need to collect bank account details from your employees or beneficiaries, including the bank name, account number, and routing number, and they must sign an authorization form agreeing to direct deposit into their account. Once set up, enter these details into your payroll system to schedule and automate payments accordingly. Plan regular updates and training for your payroll handlers to maintain system efficiency and compliance.