Profit First Accounting revolutionizes the way small businesses approach their finances by placing profit at the forefront, instead of an afterthought. This financial management system, conceived by Mike Michalowicz, could prove transformative for your business.

Today we’ll go through the core principles of Profit First Accounting, as well as how to set it up for your business, the benefits you can expect, variations, adaptations and potential pitfalls.

Also, this guide is related to our articles on 13 reasons why accounting is important, cash vs. accrual accounting, and understanding gross vs. net profit.

– Profit allocation

– Revenue management

– Business finance transformation

– Overcoming financial obstacles

– Profit-first methodology adaptation

Let’s get started!

What is Profit First?

Profit First is a financial management methodology that flips the typical formula of Sales – Expenses = Profit. Instead of taking profits last, Profit First encourages you to put your profits first, redefining the formula to Sales – Profit = Expenses.

This radical approach to business accounting was developed after serial entrepreneur Mike Michalowicz identified a serious problem with the majority of small businesses: a lack of sustainable profit.

After losing everything on an ill-advised venture, Michalowicz was compelled to reassess his own relationship with money and business. Rebuilding from the ground up, he devised the Profit First formula, which prioritized profitability over unchecked growth. Thanks in part to this, he regained his financial footing, and now shares his methods with others.

Profit First: the basics

The key point to remember: profit comes first. Seeing profits as the leftovers after paying all expenses can be the Achilles’ heel for many small businesses. With the Profit First method, you’re flipping this perspective and ensuring your business’s economic health and steady growth.

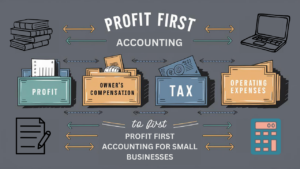

There are four main accounts to pay attention to in Profit First.

Profit: Profit is the reward for owning and running a successful business. In the Profit First methodology, profit is not what’s left over after all expenses are paid. Instead, profit is a deliberate allocation from your revenue, set aside as a priority.

Owner’s compensation: Compensate yourself for the time, talent, and energy you invest in your business. The owner’s compensation account is for paying yourself a reasonable and regular salary. Don’t forget that the work you put into your small business is also a valuable resource!

Tax: As every business owner knows, taxes are part and parcel of running a business. By setting aside part of your revenue in a tax account, you won’t be panic-stricken at tax time. It’s like having a rainy-day fund for your quarterly tax payments.

Operating expenses: After prioritizing your profit, your compensation, and taxes, what you’re left with should be spent on operating expenses. This fund is used to cover all the costs incurred from daily business transactions. These could be utility bills, rent, marketing, employee salaries, office supplies, and more.

How to set up Profit First for your business

First, you’ll need to set up bank accounts for your specific needs. Here’s what that should look like:

- Income account: This is the holding spot for all the money that comes into your business. It’s like a waiting room for your cash.

- Profit account: This account is for your future business wealth. Every quarter, you’ll be taking a profit distribution from this account.

- Owner’s pay account: Your salary comes from here.

- Tax account: An account for storing money for your near-future tax payments.

- Operating expenses account: The money in this account is for running your business.

Next, you need to decide on the allocation percentage for each of these accounts. This is where the power of Profit First comes to the fore. Let’s break this down.

Assess current financials: Look at your revenue and expenses for the past 12 months. Break down your expenses into categories such as taxes, owner’s pay, and operating expenses. This will allow you to see where your money is really going.

Set realistic allocation percentages: The allocations depend on your business’s needs, but initially, you’ll want your allocations to reflect your current reality, not a dream scenario. Small, consistent changes are better than drastic ones that might not be sustainable.

Gradually adjust allocations: This is not a one-time event. You should review and adjust your allocations every quarter based on your business needs and financial goals.

The benefits of adopting Profit First

If this is all new to you, and you’re unsure whether the switch is worth the effort, consider some of the upsides to using Profit First in your accounting.

Make every sale more profitable

With Profit First, you decide on a percentage of each sale as profit, right from the outset. You see every sale as not just revenue, but profit. So instead of “I’ll make a profit when I sell more,” it becomes, “I’ll make a profit on every item I sell.”

Control expenses better

When profit is something to figure out after tallying up expenses, those expenses can easily get out of hand. If you take your profit first though, it’s a different story. You have a fixed amount to cover expenses, and anything beyond that eats into your profit. This can lead to smarter decision-making about managing costs and staying within budget.

Realize the value of your time and effort

Small business owners often pay themselves last, after employees and all other expenses. By adopting Profit First, you place priority on your own compensation. This helps you value your time, hard work and the risks you take to run your business.

Transformed operations and mindset

It’s a myth that more sales automatically equal more profit. The truth is, your expenses often increase with sales, negating much of the potential profit. By adopting Profit First, you’ll start to focus on essential operations and scrutinize expenses.

Ask yourself, “Is this necessary? Will this help me generate profit?” This mindset keeps you focused on what truly matters: building a profitable business, not just a bigger one.

Increased financial discipline

Budgeting for expenses after taking out profit requires discipline. You might need to delay new purchases or negotiate with vendors for better deals.

To operate within a smaller budget, sometimes you might have to say “no” to non-essential expenses. This can be challenging, particularly if saying “yes” is your default response. Keep your focus on the goal–consistent profitability. Practice saying no to impulse buys or expenses that don’t align with your current strategy.

Plan for financial stability

With Profit First, you plan for profit in every financial forecast or projection you make. This habit helps prepare your business to weather downturns or unexpected costs. Because you’ve already accounted for profit, you can manage these challenges without taking a hit to your bottom line.

Profit First variations and adaptations

Profit First isn’t a one-size-fits-all solution. Different types of businesses and industries have different needs and circumstances. The beauty of Profit First is its adaptability: you can customize it to fit what you need. Let’s look at how.

Step 1: Assess your business

Like any other business strategy, the first step is to understand your business. What is your operating model? How do you make money? How much is needed to run the business? Answering these questions is the first step in customizing Profit First for your needs.

Step 2: Choose realistic percentages

Setting profit percentages is a big part of the Profit First model. But remember, there’s no right or wrong here. You want to set a realistic, yet challenging percentage that will help grow your business without causing unnecessary stress.

Step 3: Evaluation is key

Once you’ve implemented Profit First, don’t forget to evaluate. Are the profit percentages working? Are you able to meet expenses and still have profits? If not, it’s time to adjust–and keep tweaking until you find the perfect balance.

Step 4: Get expert help

Finally, don’t shy away from seeking expert help. Hire professional accountants or consultants who understand the Profit First method and make use of their expertise to help you to make adjustments that suit your business, boosting profits without hindering growth.

Profit First can be a game-changer for your business. But like any good strategy, it requires a willingness to adapt and adjust. Understand the principles, commit to applying them, and adjust as needed.

Critiques and limitations of Profit First

Profit First is a revolutionary financial management method, but like any system, it has its share of critics and potential roadblocks. Let’s look at some of these criticisms and contrasts with traditional accounting practices.

One major criticism leveled against the Profit First approach is viability. When you take your profits out first, you’re left with less money for expenses. This may be tough, especially if you’re running a tight ship.

Profit First also requires a high level of financial discipline. In the traditional model, you prioritize expenses and whatever remains is profit. But with Profit First, you’re withdrawing your profit the moment cash comes in. If you’re not careful, this could lead to cash flow issues due to improper allocation.

It’s also not an approach you can set and forget: it requires regular monitoring and adjusting. In traditional accounting, once your budget is set, you only need minor adjustments. With Profit First, you’ll need to continuously evaluate and adjust your allocations based on your profits and expenses.

The Profit First system may pose an issue for businesses that have inconsistent cash flow and could find it difficult to manage operating expenses due to the swings in income.

Some have also expressed concerns about how accurately Profit First depicts the actual financial status of a business. Business owners might be led to believe they’re faring better than they actually are, and may overlook potential financial woes in their operations or expenses. The traditional method commonly gives a clearer picture because profits are what’s left after all expenses are subtracted from revenue.

Profit First’s sustainability has also been questioned, especially for startups and growing businesses; critics argue that these businesses often need to invest and reinvest to grow, thereby making the Profit First model potentially counterproductive. Do your research and make sure it’s right for you before jumping aboard.

Conclusion

With Profit First, profits are taken out first and whatever is left goes to expenses, in contrast to traditional accounting practices, where the profit is what remains after all operating costs, overheads, and expenses have been subtracted from revenue. The Profit First model essentially flips the script on this tried-and-tested method, leading to not only increased profitability but also leaner, more efficient operations.

If you decide this is the method for you, start with small, consistent steps. Implement the basic principles of Profit First and gradually make them part of your business routine.

Make sure to tweak the system as needed until it suits your unique business needs and financial goals. And don’t overlook the importance of professional assistance. Having an expert in your corner, like a Profit First Professional, can guide your financial transformation, providing personalized advice and ongoing support.

Next, check out our articles on understanding net 30 payment terms, how to calculate profit margin, and what is a virtual CFO?

FAQ: Profit First Accounting for Small Businesses

Here's some answers to commonly asked questions about Profit First Accounting for Small Businesses.

What is Profit First Accounting?

The Profit First model is a revolutionary system conceived by Mike Michalowicz that redefines the way small businesses manage their finances. Instead of the traditional Sales – Expenses = Profit formula, Profit First encourages businesses to make profit a priority, altering the formula to Sales – Profit = Expenses. This method can improve the financial health of a business by guaranteeing regular profitability and encouraging more efficient operations.

How can the Profit First model be adapted?

The Profit First model can be adapted for different businesses by customizing the profit percentages according to the specific needs and circumstances of each business. It begins with understanding the business, setting realistic and challenging profit percentages, evaluating and adjusting these percentages regularly, and seeking expert help if necessary. The Profit First model isn’t a one-size-fits-all solution; it can and should be tailored to suit each business’s unique needs and goals.

What are the limitations or potential downsides of Profit First?

Critics of the Profit First model question its practicality, especially for startups and growing businesses that often need to invest and reinvest to grow. The model requires a high level of discipline and constant monitoring, which some may find demanding. It could also potentially lead to cash flow issues due to incorrect allocation, and there are some concerns about it providing an inaccurate view of a business’s financial health by making the profits seem higher than they actually are. Transitioning to Profit First from traditional practices can also pose a steep learning curve for some business owners.