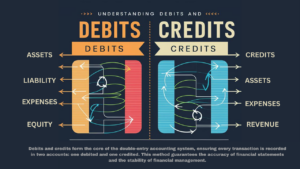

Debits and credits form the core of the double-entry accounting system, ensuring every transaction is recorded in two accounts: one debited and one credited. This method guarantees the accuracy of financial statements and the stability of financial management.

Understanding debits and credits is essential for anyone looking to grasp the fundamentals of financial literacy and accounting.

This guide is also related to our articles on understanding journal entries in accounting, double-entry accounting: the basics, and 14 common accounting errors and how to avoid them.

- Double-entry accounting system

- Debits and credits in accounting

- Balancing the accounting equation

- Debits and credits examples

- Impact of debits and credits on financial statements

Let’s dive in!

Section 1: The basics of debits and credits

Definition of debits and credits

In the world of accounting, every transaction your business makes will touch two spots: one’s debited and one’s credited. Here’s the simple breakdown: when you debit an account, you’re adding to it. Think of it as the “incoming” side. Credits, on the other hand, are the opposite. They usually mean money going out or being allocated elsewhere. For instance, when you make a sale, you credit your sales account because you’re increasing it.

The double-entry accounting system

This two-pronged approach is what we call the double-entry accounting system. It’s a fail-safe to make sure every penny coming into and going out of your business is accounted for. By recording transactions twice, it’s easier to keep track of where your money is at all times. This method is crucial for keeping your books balanced and making informed financial decisions.

Historical origins

The concept isn’t new; it dates back to the 15th century, invented by an Italian mathematician named Luca Pacioli. It’s stood the test of time because it works, offering a clear picture of a business’s financial health by making sure assets always equal liabilities plus equity.

How it ensures financial stability and accuracy

By sticking to this system, you’re less likely to encounter surprises when it comes to your finances. It makes sure that every action is counterbalanced, which means your accounting books stay in harmony. This method doesn’t just record transactions; it provides a real-time snapshot of your financial standing, allowing you to make adjustments as needed.

Visual representation: T-accounts

To visualize how debits and credits work, accountants use something called T-accounts. They’re simple: the left side (debit) and the right side (credit). Every transaction is entered twice, once on each side, depending on its nature. This visualization helps you see the flow of money in and out of your accounts, making it easier to grasp the effects of your business decisions on your overall financial health.

Section 2: Understanding the accounting equation

Introduction to the accounting equation: Assets = liabilities + equity

At its core, the accounting equation is a simple but powerful tool that represents the relationship between your business’s assets, liabilities, and equity. Assets are what your business owns, liabilities are what it owes, and equity is the owner’s share in the business. The equation keeps everything in balance: Assets = Liabilities + Equity. This balance is the foundation of your company’s financial health and helps in making strategic business decisions.

Role of debits and credits in maintaining the balance of the accounting equation

Debits and credits are the mechanisms that keep this equation in balance. When you debit an asset account, you increase it; when you credit a liability or equity account, you also increase it. This might seem a bit confusing at first, but it’s all about understanding which side of the equation you’re working on. If you buy a new piece of equipment (an asset), you might pay cash (reducing another asset) or take on a loan (increasing liabilities), but either way, the total on both sides of the equation remains equal.

Examples of common transactions and their impact on the accounting equation

- Purchasing inventory with cash: When you buy inventory, your assets (inventory) increase, but your assets (cash) decrease. The total assets don’t change, keeping the equation balanced.

- Taking out a loan to purchase equipment: This transaction increases both your assets (equipment) and your liabilities (loan). Your total assets go up, but so do your liabilities, maintaining the balance.

- Earning revenue from sales: Earning revenue increases your assets (cash or accounts receivable) and your equity (through retained earnings). Both sides of the equation increase, keeping everything in harmony.

- Paying off a loan: Paying off a loan decreases your liabilities (the loan) and your assets (cash), but the overall balance of the equation is preserved.

- Investing more cash into the business: When you, as the owner, invest more cash, your assets (cash) increase, and your equity (owner’s equity) also increases. The increase is mirrored on both sides of the accounting equation.

Each of these examples shows how everyday business transactions affect the balance of assets, liabilities, and equity. By understanding the flow of debits and credits through these transactions, you’re not just recording numbers; you’re keeping a pulse on the financial health of your business, ensuring that for every action there’s an equal and opposite reaction in your books. This balance is crucial for transparency, accuracy, and the successful management of your business’s finances.

Section 3: Debits and credits in practice

Understanding how debits and credits work with different types of accounts is like getting the keys to your business’s financial engine. Here’s a breakdown of how these entries affect various accounts:

Asset accounts

- Debits: Increase asset accounts. When you buy equipment or stock up on inventory, you’re adding value to your business.

- Credits: Decrease asset accounts. Paying bills or buying something on credit reduces your assets.

Liability accounts

- Debits: Decrease liability accounts. Paying down a loan reduces what you owe.

- Credits: Increase liability accounts. Taking out a new loan or purchasing with a credit card increases your liabilities.

Equity accounts

- Debits: Decrease equity accounts. Drawing funds for personal use decreases your ownership value.

- Credits: Increase equity accounts. Investing more money or earning profits boosts your stake in the business.

Expense accounts

- Debits: Increase expense accounts. Buying supplies or paying rent for your office space increases your expenses.

- Credits: Decrease expense accounts. Returns or refunds on things you’ve bought for the business lower your expenses.

Revenue accounts

- Debits: Decrease revenue accounts. Issuing a refund to a customer lowers your revenue.

- Credits: Increase revenue accounts. Making a sale or earning a fee for services increases your business income.

Practical examples: Recording common business transactions

- Purchasing inventory: Debit your inventory account to show an increase in assets, and credit your cash or bank account to reflect the payment.

- Paying off a loan: Debit your loan account to decrease your liabilities, and credit your bank account to show the outflow of cash.

- Earning revenue from services: Credit your revenue account to increase income, and debit your cash or accounts receivable to show the inflow of funds.

In practice, managing these transactions keeps your financial records accurate and up-to-date. Each entry has a direct impact on your business’s financial statements, affecting your ability to make informed decisions.

Here’s how to apply this to your day-to-day operations:

- Keep a close eye: Regularly review your accounts to understand how your business activities are affecting your financial health.

- Record accurately: Make sure every transaction is recorded correctly. Mistakes can throw off your financial analysis.

- Understand the impact: Recognize how everyday operations affect your overall financial standing. This awareness can guide your business strategies.

By mastering the application of debits and credits across different accounts, you’re not just doing bookkeeping; you’re steering your business with a clear view of your financial landscape. This approach helps maintain a healthy balance sheet and supports sustainable growth.

Section 4: Advanced concepts and applications

Navigating the more complex aspects of accounting, like understanding the nuances of accrual versus cash accounting and preparing financial statements, is crucial for a comprehensive grasp of how your business operates financially. Let’s dive into these concepts:

Debits and credits in accrual vs. cash accounting

- Accrual accounting: Records transactions when they occur, regardless of when cash is exchanged. This means you debit or credit accounts as you earn revenue or incur expenses, not necessarily when money changes hands.

- Cash accounting: Records transactions only when cash is received or paid. Here, you debit or credit your accounts based on actual cash flow. While simpler, it might not always give the full picture of your financial health like accrual accounting does.

The role of debits and credits in financial statement preparation

Understanding how to prepare key financial statements using debits and credits can give you insights into your business’s financial health.

- Balance sheet: Reflects your business’s assets, liabilities, and equity at a point in time. Debits and credits help ensure that the equation (Assets = Liabilities + Equity) always balances, giving a snapshot of your financial position.

- Income statement: Shows your revenue and expenses over a period. Debits increase expenses and decrease revenue, while credits do the opposite. This statement highlights the profitability of your business.

- Statement of cash flows: Tracks the flow of cash in and out of your business. Understanding debits and credits is essential to accurately categorize operations, investing, and financing activities, showing how cash is being used and generated.

Impact of debits and credits on financial analysis and decision-making

- Accuracy: Proper use of debits and credits ensures accuracy in your financial statements, which is vital for analyzing your business’s financial health.

- Insights: By accurately recording transactions, you can glean insights from your financial statements about profitability, liquidity, and solvency.

- Strategic decisions: Understanding the financial impact of different transactions helps in making informed, strategic business decisions. For example, you can better manage cash flow, evaluate investment opportunities, and plan for growth.

In practice, these advanced applications of debits and credits are not just about keeping your books accurate. They are about providing you with the tools to analyze your business’s performance, identify trends, and make decisions that align with your long-term goals. Whether it’s deciding to cut expenses, invest in growth, or manage debt, the clarity provided by your financial statements rooted in the accurate application of debits and credits can guide your strategic planning and help your business thrive.

Conclusion

Debits and credits form the cornerstone of financial tracking in business, ensuring transactions are balanced and financial records are accurate. This dual-entry system plays a crucial role in managing assets, liabilities, equity, expenses, and revenue, thereby maintaining financial stability and accuracy. Embracing real-life examples and simulations is key to becoming proficient in handling debits and credits, which are fundamental for assessing a business’s financial health and making informed decisions.

Achieving mastery over debits and credits is essential for financial literacy, offering a transparent view of a company’s financial status and aiding in the preparation and analysis of financial statements. This understanding not only aids in precise bookkeeping but also lays the foundation for a business’s success. As such, delving into the practical application of debits and credits through hands-on practice is highly encouraged for anyone looking to enhance their financial knowledge and contribute to their business’s growth.

Next, check out our articles on how to calculate burn rate, 15 accounting statistics and trends to know, and bank reconciliation example: step by step.

FAQ: Understanding Debits and Credits

Here's some answers to commonly asked questions about Understanding Debits and Credits.

What are debits and credits in accounting?

In accounting, debits and credits are entries that record financial transactions in the double-entry accounting system. Every transaction affects two accounts: one is debited and the other is credited. A debit entry in an account signifies an increase in assets or expenses and a decrease in liabilities, equity, or revenue. Conversely, a credit entry signifies a decrease in assets or expenses and an increase in liabilities, equity, or revenue. This system ensures the accuracy and balance of financial records, reflecting the company’s financial health accurately.

How do debits and credits affect the accounting equation?

The accounting equation (Assets = Liabilities + Equity) forms the foundation of the double-entry accounting system. Debits and credits play a crucial role in maintaining the balance of this equation. When an asset account is debited, its value increases, and when it’s credited, its value decreases. For liabilities and equity, it’s the opposite. The dual entry of each transaction one account debited and another credited ensures that the total assets always equal the sum of liabilities and equity, thereby keeping the company’s financial statements balanced and accurate.

Why is it important to understand debits and credits in accounting?

Understanding debits and credits is vital for anyone involved in financial management or bookkeeping. This foundational knowledge enables the accurate recording and interpretation of financial transactions, which is essential for preparing financial statements, analyzing a company’s financial health, and making informed business decisions. Moreover, mastering debits and credits enhances financial literacy, contributing to better management of assets, liabilities, and equity. It ensures transparency in financial reporting and supports strategic planning, helping businesses maintain stability, accuracy in their financial records, and facilitating sustainable growth.