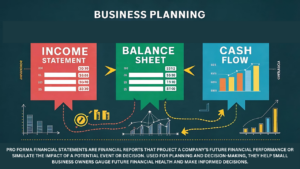

Pro forma financial statements are financial reports that project a company’s future financial performance or simulate the impact of a potential event or decision. Used for planning and decision-making, they help small business owners gauge future financial health and make informed decisions.

This article explains how pro forma financial statements assist in business planning, their types, purposes, and how to create them. We’ll also go into how they can affect decision-making, risk assessment, and strategic planning.

Also, this guide is related to our articles on understanding retained earnings, cash vs. accrual accounting, and understanding gross vs. net profit.

- Pro forma income statement

- Cash flow pro forma

- Pro forma balance sheet

- Importance of pro forma financial statements

- Using pro forma in business planning

Let’s get started!

Types of pro forma statements

There are three primary types of pro forma statements: income statements, balance sheets, and cash flow statements.

Income statements

An income statement is basically a financial report that shows how much you’re making versus how much you’re spending over a certain period; it’s also known as the profit and loss statement. By subtracting your total expenses from your total revenue, you get your net income. The income statement is typically used for analyzing your business’ profitability.

Balance sheet

The balance sheet delivers an overview of your business’s financial health at a particular point in time. It lists your assets, liabilities, and equity (basically what’s left after you subtract the liabilities from the assets), and is helpful when you need to see your financial standing and figure out your business net worth. Make sure to keep your balance sheet up-to-date, as it often serves as a reference for potential lenders or investors.

Cash flow statement

Finally, there’s the cash flow statement. This statement displays how cash flows in and out of your business over a specific period, indicating where the cash is coming from (cash inflows) and where it’s going (cash outflows). The cash flow statement is useful when you want to determine your liquidity, how much cash you’ve got readily available.

If you’re aiming to score a loan or attract investors, the cash flow statement is a testament to your ability to manage cash resources effectively and is a good gauge of your business’ health–or lack thereof.

How pro forma statements help in decision-making

A pro forma statement is a bit like a financial crystal ball. It helps you peer into the future of your business and make informed financial decisions. How? Let’s find out.

Pro forma statements project the returns on potential investments, such as new equipment, staff or premises. They factor in sales estimations, cost, tax and other necessities to give a rounded view of future profitability or risks, so you can make decisions with more confidence.

Importance in evaluating future projects and business growth

Taking on a new project or expanding your business can feel like a high-stakes gamble. Strip away the guesswork and minimize risks with pro forma statements: their projections provide hard numbers about expected costs and revenues, so you can assess the viability of a new service or product line, a marketing campaign, or a strategic shift in your business model.

Additionally, they are a must when approaching lenders for new finance or meeting with potential investors–anywhere you need to show detailed financial plans.

Whether you’re considering a minor project or a major expansion, pro forma statements give you a roadmap to make decisions. No more blind leaps of faith–just informed, strategic plans to take your business to the next level.

Creating pro forma statements

Creating a pro forma income statement starts with projecting your future revenues. Where will your sales come from? At what price and in what quantity? Project these figures monthly for the next year.

Next, estimate the cost of selling your goods or services. Include any direct costs like materials, labor, and manufacturing. Make sure you consider changes in these costs as sales volumes go up or down.

Then list all your operating expenses, including indirect costs like marketing expenses, salaries and rent. Start with current costs and factor in realistic changes. Remember, these figures are not set in stone, and can be adjusted as needed.

Finally, to calculate your net income, subtract the cost of goods and the operating expenses from your sales. This is your projected profit.

When making a pro forma balance sheet, start with your current balance sheet. Make changes to reflect your projections from the income statement. For example, as you sell more, your cash will increase. Any new facilities or equipment should be included, too.

Finally, for the pro forma cash flow statement, show all cash inflows from your sales and other income sources. Then list out the cash outflows, which include all your business expenses. Subtract your total outflows from your total inflows to get your net cash flow.

Key adjustments and common assumptions

There are some key adjustments and assumptions that are commonly made in pro forma statements. Here are a few:

- Cost reductions: if you plan on using technology or other methods to reduce costs, this should be reflected in the projections.

- Sales growth: you may assume a certain percentage increase in sales based on market research or previous trends.

- Market expansion: you might project an increase in revenues due to entering a new market or geographical area.

Key components

Start with a historical statement, a record of your business’s financial history. Then use this as your jumping-off point for your pro forma statement. Once you have this, pro forma statements are like a ‘what if’ scenario. What if your sales increase by a certain percentage? What if you were to cut costs? These are questions that pro forma statements try to answer–without any outlay or investment on the line.

Two important components of pro forma statements include revenues and expenses. Your projected revenues would consider variables like price, quantity sold, and growth rate. Your expenses, on the other hand, are typically broken down into costs of goods sold and operating expenses.

Costs of goods sold are all the expenses related directly to producing your products or providing your services. This might include material costs, labor, and overhead.

Operating expenses are costs that are not directly related to production but are essential for running your business; for example, salaries, rent, utilities, and marketing.

Taken together, your revenues and expenses inform your projection of net income—your expected profits or losses over the time period you’re looking at.

How assumptions are formulated

Assumptions in pro forma statements are based on both historical data and future projections. Historical data gives you a sense of your business’s performance and trends over time. For example, if your sales have been consistently growing by 10% each year, you might incorporate this into your pro forma projection.

Future projections are sensitive and require careful thought. Consider factors that might influence your business in the future, both internally (e.g., changes in strategy or operations) and externally (e.g., economic conditions or competitor activity).

Making these assumptions requires a balance of optimism and realism. Overly optimistic projections can lead to disappointment and strategic missteps. On the other hand, if you’re overly conservative, you might miss opportunities for growth and expansion.

Aim to strike a balance, and be prepared to adjust your projections as new information comes to light.

Using pro forma statements in business decisions

Say you’re considering introducing a new product line. How do you get a feel for the financial implications? A pro forma income statement can offer you a picture of what your financial situation might look like if you proceed with the product launch. You can adjust for changes in things like sales volume, production costs, and even price per unit. Suddenly, those variables are less scary.

Or perhaps you’re viewing a potential acquisition. By using a pro forma balance sheet, you’ll have a better understanding of how the purchase could impact your assets, liabilities and equity. By integrating the target company’s assets and liabilities with yours, you’ll get an idea of what your post-acquisition financial position would be.

A pro forma cash flow statement can also help predict how your cash flow could alter with changes in your operation. It could be a new marketing strategy, or perhaps a scenario like moving your manufacturing overseas. By working through the pro forma, you’re better positioned to make an informed decision.

Risk assessment and pro forma statements

Risk is an inevitable part of business. Here’s how pro forma statements can help, though: by showing scenarios that could impact your company and outlining their potential financial outcomes, you’re basically developing a roadmap of possibilities.

A pro forma statement doesn’t just look at the best-case outcome. You can run worst-case scenarios as well to identify possible risks and setbacks.

Pro forma vs. standard financial statements

The main point of a pro forma financial statement is to highlight the estimates and assumptions your business makes about future events and financial performance. If you’re considering a significant change, they can help you visualize what your finances might look like afterwards.

Unlike pro forma, standard financial statements detail your actual financial performance–the real income, expenses, assets, and liability figures of your past. They are certified by an independent auditor, making them a more reliable reflection of your business’s financial history.

Typically, you’ll have to prepare four types of standard financial statements: income statement, balance sheet, cash flow statement, and the statement of owner’s equity. These provide a comprehensive look at your business’s financial health and are often required by lenders, investors, and tax authorities.

Here’s a simple rule for knowing when to use pro forma vs standard financial statements: use pro forma when you want to plan for the future, and use standard financial statements to reflect on the past and present.

If you’re considering a major business change, make a pro forma statement to project the potential financial outcome of that change, and use standard financial statements for an accurate reflection of your business’s current financial status.

Challenges and limitations of pro forma statements

While pro forma statements are powerful planning tools, they come with their own set of challenges and limitations that you should be aware of.

Bias and assumptions

Pro forma statements are based on a series of assumptions about future events. If these assumptions are overly optimistic or not grounded in reality, your financial forecasts can be skewed. This is known as projection bias and can lead to business decisions based on inaccurate information.

Lack of standards

Unlike standard financial statements, which are governed by strict rules and regulations, pro forma statements have no common standard. This means that the ways you create and present your pro forma statements can vary greatly, which can lead to misunderstanding or misinterpretation of the data.

Tips to help you critically analyze pro forma results

Given these limitations, being able to critically analyze your pro forma results is an important skill. Here are a few tips for doing just that.

- Understand the assumptions: Each pro forma statement is built on a set of assumptions. First, make sure you understand these assumptions and that they are reasonable and realistic. If an assumption seems off, don’t hesitate to question it and adjust as necessary.

- Check consistency : It’s very important to maintain consistency from one statement to the next. This means using the same methods to calculate your projections each time. If you change how you calculate your numbers, make sure that change is clearly noted.

- Evaluate multiple scenarios: Another good tip is to create multiple pro forma statements with all kinds of scenarios, including best, worst, and most likely. This tactic will give you a broader range of potential outcomes to consider and plan for.

- Ask for a second opinion: It never hurts to ask for a second opinion on your pro forma statements. Whether it’s your accountant, business mentor, or financial advisor, another set of fresh eyes can provide valuable perspective and may notice something you missed.

Conclusion

Both pro forma and standard financial statements play their roles in your business financials. Standard statements tell people your monetary history, while pro forma statements map out possible financial futures. Use standard statements to reflect on where you’ve been financially, and use pro forma statements to project where you could go.

Make sure you understand the assumptions your pro forma statements are based on. Stay consistent, consider multiple scenarios, and don’t shy away from asking for a second opinion. Treat them as helpful guides for your business decisions.

Next, check out our articles on 101: a guide to bookkeeping basics, 18 best accounting software, apps & tools in 2024, and 15 accounting statistics and trends to know.

FAQ: Pro Forma Financial Statements for Business Planning

Here's some answers to commonly asked questions about Pro Forma Financial Statements for Business Planning.

Why are pro forma financial statements important?

Pro forma financial statements provide forward-looking financial projections which businesses can use to gauge their future financial health. By showing the estimated returns on potential investments and assessing potential losses or risks based on a variety of scenarios, they allow companies to make informed decisions. This makes these statements invaluable for strategic planning, risk assessment, and making major business decisions such as undertaking new projects or business expansions.

How do I make pro forma financial statements?

Creating pro forma financial statements involves a series of steps starting with projecting future revenues. Pro forma income statements, balance sheets, and cash flow statements each require specific estimations and adjustments. Changes are made based on assumptions rooted in both historical data and future projections, based on financial expertise and an understanding of the business and market.

What are the limitations and challenges associated with pro forma financial statements?

While pro forma financial statements are beneficial, they also have limitations. They are built on a series of assumptions about future events, meaning if these assumptions are too optimistic or incorrect, the financial forecasts can be skewed. And unlike standard financial statements, pro forma statements are not governed by strict rules and regulations.